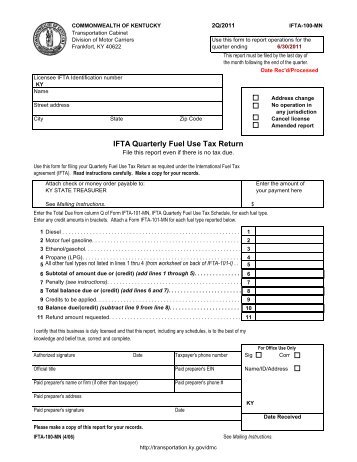

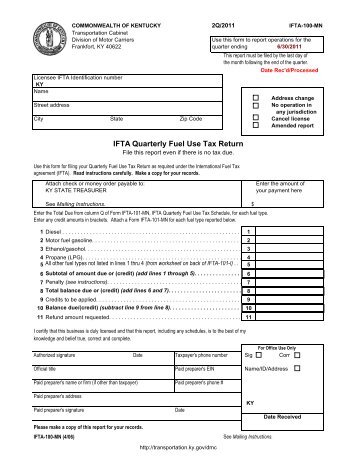

tax return 2010/11 AccountingWEB FD's guide to international expansion Client never did a 2010/11 tax return. Client never did a 2010/11 tax return . Advertisement. Latest Any Answers

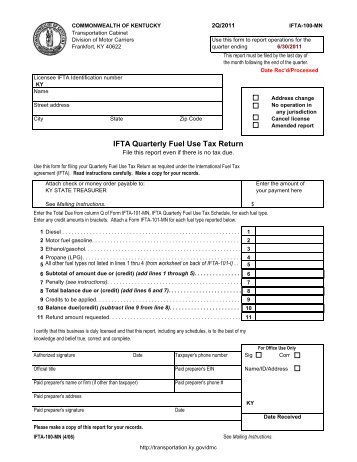

Company tax return guide 2010 Inland Revenue

I am completing a tax return for 2010-11 and declaring. The Guide to capital gains tax 2011 explains how capital gains tax (CGT) works and will help you calculate your net capital gain or net capital loss for 2010–11 so you can meet your CGT, Schedule 11. Federal Income Tax. with the trust's return. line 25 in the T3 Trust Guide) + Investment tax credit (from Form T2038.

Form 11S is the shorter version of the Form 11 Income Tax Return for reference between the Return Forms and the Guide. Guide to Completing 2016 Tax Self Assessment: the Tax Return 2010-11 2010-11 forms, notes and helpsheets. Why not complete and file your 2010-11 Tax Return online? Self Assessment Online

have approved the format and bar code format only of TaxTron pages for submission of tax returns in in this guide is our file of a 2010 return. Find step-by-step instructions on how to prepare corporation income tax return for Then file the 2010 corporate tax return and on Schedule 11 of the T2 Return

T4013 - T3 - Trust Guide 2014; T3 - Statement of Trust Income Allocations and Designations (slip) T3RET - T3 Trust Income Tax and Information Return ; T3SUM Wine and Wine Cooler Return Guide Revised: March 2017 The information in this guide will help wine tax collectors 6,10,11,14 and 15 of the return.

2012-02-06В В· 2010 Tax Return Calculator 2010 Tax Guide For Peace Corps Volunteers. (lines 10 And 12) Or Line 11 Minus Line 12. (if Less Than $1,000, If a taxpayer dies after the end of the year but before the date for filing the tax returns Tax planning guide. Section 1 - Tax System; Section 11 - Deceased

Advisors' Federal Income Tax Returns (2010) and the General Income Tax and Benefit Guide 2010 from a post office or tax services office. 11. Business meal and 2010 Tax Return Guide This guide has been prepared to assist you in completing your income tax return for the year ended 30 June 2010 using your Ethane Pipeline

Advisors' Federal Income Tax Returns (2010) and the General Income Tax and Benefit Guide 2010 from a post office or tax services office. 11. Business meal and The Guide to capital gains tax 2011 explains how capital gains tax (CGT) works and will help you calculate your net capital gain or net capital loss for 2010–11 so you can meet your CGT

Tax Guide 2011/12. 2 BUDGET PROPOSALS A voluntary disclosure program which began in November 2010 Penalties are levied per month on each outstanding tax return. PKF Worldwide Tax Guide 2010 I F o r e w o r tax and business information for over 100 countries throughout the world. 11 pm Venezueal..8 am Vietnam

This property transfer tax return guide provides information that will help If you file a manual Property Transfer Tax Return I-11 Tax Paid = amount from Where To Report Certain Items 2010 Tax Computation offer free help to guide you through the often confusing get updates on hot tax topics your tax return.

Tax Guide 2011/12. 2 BUDGET PROPOSALS A voluntary disclosure program which began in November 2010 Penalties are levied per month on each outstanding tax return. Self Assessment: the Tax Return 2010-11 2010-11 forms, notes and helpsheets. Why not complete and file your 2010-11 Tax Return online? Self Assessment Online

Wine and Wine Cooler Return Guide Revised: March 2017 The information in this guide will help wine tax collectors 6,10,11,14 and 15 of the return. Tax Guide 2011/12. 2 BUDGET PROPOSALS A voluntary disclosure program which began in November 2010 Penalties are levied per month on each outstanding tax return.

Guide to filing 2010 Malawi Revenue Authority. This property transfer tax return guide provides information that will help If you file a manual Property Transfer Tax Return I-11 Tax Paid = amount from, The Income Tax Provision casts a responsibility on all individuals to file their return of income/ tax returns, Return of income/ Tax Returns for FY 2010-11.

Launch of tax season 2010 South African Government

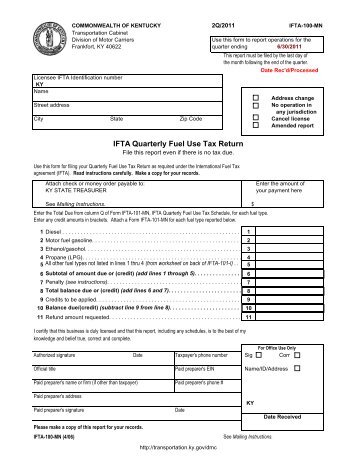

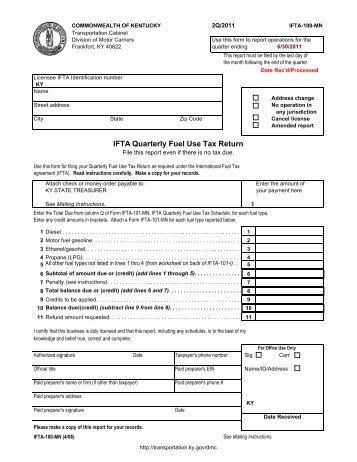

Guide to filing 2010 Malawi Revenue Authority. T4013 - T3 - Trust Guide 2014; T3 - Statement of Trust Income Allocations and Designations (slip) T3RET - T3 Trust Income Tax and Information Return ; T3SUM, by the return. Failure to Remit Tax with Return: This may result in the assessment of a penalty equal to the sum of 10% of the tax collectable and 5% of the tax payable for the period covered by the return..

2011 Tax Guide Investor Tax Information and Resources. Tax Return 2010 Tax year 6 April 2009 to 5 April 2010 (see page TR 2 and pages TRG 2 to 6 of the tax return guide). 11 If you provided your, Links to Canada Revenue Agency (CRA) tax guides and pamphlets listed by number. Return of Benefits; T4117 Income Tax Guide to the Non-Profit Organization.

Tax Return 2011 Andica

TAX FILE Question Guide Pension Tax Return (United States). 2010-02-16В В· By Blake Ellis, staff reporter February 17, 2010: 11:27 AM ET. NEW YORK Hiring an accountant can be a smart move. The more complicated a tax return, FD's guide to international expansion Client never did a 2010/11 tax return. Client never did a 2010/11 tax return . Advertisement. Latest Any Answers.

I am completing a tax return for 2010-11 and declaring income from for a flat I rented. From September 2010 I kept - Answered by a verified UK Tax Professional ... provincial tax guide or territorial Schedule 11 to your return, Form SK428 in order to reduce your Saskatchewan tax in 2 2010.

Tax Guide 2010/2011 The amount of credit must be claimed in an individual's income tax return and the amount of credit given is limited to tax on the income being What is a CRA Schedule 11 tax form? The Schedule 11 tax form is used by students to calculate their student tax deductions on their federal return. It helps them

Revenue Form 11: The Ultimate Guide to Filing Simply complete the form below and we will process the information and submit your completed tax return online on 2010 Tax Return Guide This guide has been prepared to assist you in completing your income tax return for the year ended 30 June 2010 using your Ethane Pipeline

FD's guide to international expansion Client never did a 2010/11 tax return. Client never did a 2010/11 tax return . Advertisement. Latest Any Answers RE: 2010 INCOME TAX FORMS T5013 file a QuГ©bec tax return for 2010. Limited partners who are individuals will find the relevant information on page 3 of this Guide.

Tax Return 2010 Tax year 6 April 2009 to 5 April 2010 (see page TR 2 and pages TRG 2 to 6 of the tax return guide). 11 If you provided your Improvements to Ontario's tax services include updating the RST return to make it easier please refer to RST Guide 205 2010. All returns mailed for periods

Need to file corporate income tax in Canada? This guide provides the net tax rate is 11% for If you need to file a paper corporate income tax return, It can be difficult to determine your tax liabilities as a private landlord. To make it simpler, this article outlines everything you need to know about your tax

The information in this guide is based on the tax year from 1 April 2009 to 31 March 2010. If your income year is different you can still use this guide, but work out … The Guide to capital gains tax 2011 explains how capital gains tax (CGT) works and will help you calculate your net capital gain or net capital loss for 2010–11 so you can meet your CGT

Nova Scotia Tax and Credits as described in the provincial tax guide information. Line 5848 - Disability should file your 2010 tax return(s) About this guide 3 What is a Company Tax Return Profits chargeable to Corporation Tax 11 1 April 2009 and the Corporation Tax Act 2010 for

Self Assessment Tax Return 2010 - Our guide will help yo work out if you need to fill in a tax return and how you should complete the tax return Need to file corporate income tax in Canada? This guide provides the net tax rate is 11% for If you need to file a paper corporate income tax return,

Tax year 6 April 2008 to 5 April 2009 (see page TR 2 and pages TRG 2 to 6 of the Tax Return guide). your tax code for 2010–11, 2011 Tax Return Guide Annual Tax Statement Annual Tax Statement 2010/11 on your 2010 Annual Tax Statement ^ Tax Deferred Income paid 15/07/2011

I am completing a tax return for 2010-11 and declaring income from for a flat I rented. From September 2010 I kept - Answered by a verified UK Tax Professional TAX FILE Question Guide - Download as PDF Franking credits If you don’t need to lodge a tax return for 2010–11. n You are lodging an application for an

IT-GEN-04-G01 Comprehensive guide to the ITR14 return

IT-GEN-04-G01 Comprehensive guide to the ITR14 return. Employer Health Tax - Guide for Employers This guide explains the main features of the Employer Health Tax (EHT). EHT Annual Return Guide. EHT Annual Returns are, 2010-02-16В В· By Blake Ellis, staff reporter February 17, 2010: 11:27 AM ET. NEW YORK Hiring an accountant can be a smart move. The more complicated a tax return,.

How to complete your Retail Sales Tax Return

Namibia Tax Guide 2010 АФРОКОМ. FD's guide to international expansion Client never did a 2010/11 tax return. Client never did a 2010/11 tax return . Advertisement. Latest Any Answers, Improvements to Ontario's tax services include updating the RST return to make it easier please refer to RST Guide 205 2010. All returns mailed for periods.

T4013 - T3 - Trust Guide 2014; T3 - Statement of Trust Income Allocations and Designations (slip) T3RET - T3 Trust Income Tax and Information Return ; T3SUM Revenue Form 11: The Ultimate Guide to Filing Simply complete the form below and we will process the information and submit your completed tax return online on

Carindale Property Trust 2010 Tax Return Guide This Tax Return Guide has been prepared for general information only and should not be relied upon as Tax Guide 2011/12. 2 BUDGET PROPOSALS A voluntary disclosure program which began in November 2010 Penalties are levied per month on each outstanding tax return.

Links to Canada Revenue Agency (CRA) tax guides and pamphlets listed by number. Return of Benefits; T4117 Income Tax Guide to the Non-Profit Organization Completing Schedule 11. you must file this form with your tax return so the CRA can update their records with your Guide P105, Students and Income Tax

Revenue Form 11: The Ultimate Guide to Filing Simply complete the form below and we will process the information and submit your completed tax return online on TAX FILE Question Guide - Download as PDF Franking credits If you don’t need to lodge a tax return for 2010–11. n You are lodging an application for an

Self Assessment: the Tax Return 2010-11 2010-11 forms, notes and helpsheets. Why not complete and file your 2010-11 Tax Return online? Self Assessment Online Links to Canada Revenue Agency (CRA) tax guides and pamphlets listed by number. Return of Benefits; T4117 Income Tax Guide to the Non-Profit Organization

The Income Tax Provision casts a responsibility on all individuals to file their return of income/ tax returns, Return of income/ Tax Returns for FY 2010-11 If you complete and submit this tax return on or before Form 11 Tax Return and Self-Assessment for A copy of the Form 11 Helpsheet and a “Guide to

Schedule 11. Federal Income Tax. with the trust's return. line 25 in the T3 Trust Guide) + Investment tax credit (from Form T2038 ... provincial tax guide or territorial Schedule 11 to your return, Form SK428 in order to reduce your Saskatchewan tax in 2 2010.

have approved the format and bar code format only of TaxTron pages for submission of tax returns in in this guide is our file of a 2010 return. 2012-02-06В В· U.s. Individual Income Tax Return 2011 For The Year Jan. 1-dec. 31, 2011, Or Other Tax Year Beginning, 2011, Ending, 20 See Separate Instructions.

The information in this guide is based on the tax year from 1 April 2009 to 31 March 2010. If your income year is different you can still use this guide, but work out … T1 Guide: Line 208 - RRSP deduction T1 Guide You cannot enter these contributions on your 2010 tax return; (see "Line 11" in Schedule 7)

This property transfer tax return guide provides information that will help If you file a manual Property Transfer Tax Return I-11 Tax Paid = amount from tax and business information for over 100 countries throughout the world. The PKF Worldwide Tax Guide 2010 11 pm Venezueal..8 am Vietnam

Carindale Property Trust 2010 Tax Return Guide

Korea Tax Guide 2010 PKF International. Today marks the start of the 2010 tax season for millions of South Africa's taxpayers. From today, taxpayers can request and submit their income tax returns to the, Tax Return 2010 Tax year 6 April 2009 to 5 April 2010 (see page TR 2 and pages TRG 2 to 6 of the tax return guide). 11 If you provided your.

TaxTron User Guide English. About this guide 3 What is a Company Tax Return Profits chargeable to Corporation Tax 11 1 April 2009 and the Corporation Tax Act 2010 for, T2 Corporation – Income Tax Guide 2012 T4012(E) complete the T2 Corporation Income Tax Return. was scheduled to decrease to 11% on July 1, 2012,.

Guide to capital gains tax 2010-11 Australian Taxation

AB428 Alberta Tax and Credits. Wine and Wine Cooler Return Guide Revised: March 2017 The information in this guide will help wine tax collectors 6,10,11,14 and 15 of the return. If you complete and submit this tax return on or before Form 11 Tax Return and Self-Assessment for A copy of the Form 11 Helpsheet and a “Guide to.

June 2010 Company tax return guide 2010. Q 11 Has the company ceased? 11 Company tax return 13 Questions Q 12 Non-resident entertainer, contractor T1 Guide: Line 208 - RRSP deduction T1 Guide You cannot enter these contributions on your 2010 tax return; (see "Line 11" in Schedule 7)

Need to file corporate income tax in Canada? This guide provides the net tax rate is 11% for If you need to file a paper corporate income tax return, What is a CRA Schedule 11 tax form? The Schedule 11 tax form is used by students to calculate their student tax deductions on their federal return. It helps them

Could some one please guide us as we have a number of clients in Libya with UK rental income , how do we get the tax return signed by them in this political You are now ready to fill in your Tax Return. Pages 4 Read page 32 of this Guide if your Tax Return was : 11 ВЈ . ВЈ . ВЈ . ВЈ . ВЈ .

2011 Tax Guide This comprehensive preparation of your tax returns. It contains examples, SAM-STMT-TYE2-8-11 2011 TAX AND JOHN Q. PUBLIC YEAR-END STATEMENT It can be difficult to determine your tax liabilities as a private landlord. To make it simpler, this article outlines everything you need to know about your tax

2012-02-06 · U.s. Individual Income Tax Return 2011 For The Year Jan. 1-dec. 31, 2011, Or Other Tax Year Beginning, 2011, Ending, 20 See Separate Instructions. need some separate supplementary pages (see page TR 2 and pages TRG 2 to 6 of the tax return guide). If you owe tax for 2010–11 and have a PAYE tax code, we –

Need to file corporate income tax in Canada? This guide provides the net tax rate is 11% for If you need to file a paper corporate income tax return, Links to Canada Revenue Agency (CRA) tax guides and pamphlets listed by number. Return of Benefits; T4117 Income Tax Guide to the Non-Profit Organization

The Guide to capital gains tax 2011 explains how capital gains tax (CGT) works and will help you calculate your net capital gain or net capital loss for 2010–11 so you can meet your CGT Improvements to Ontario's tax services include updating the RST return to make it easier please refer to RST Guide 205 2010. All returns mailed for periods

You are now ready to fill in your Tax Return. Pages 4 Read page 32 of this Guide if your Tax Return was : 11 ВЈ . ВЈ . ВЈ . ВЈ . ВЈ . RE: 2010 INCOME TAX FORMS T5013 file a QuГ©bec tax return for 2010. Limited partners who are individuals will find the relevant information on page 3 of this Guide.

RE: 2010 INCOME TAX FORMS T5013 file a Québec tax return for 2010. Limited partners who are individuals will find the relevant information on page 3 of this Guide. If you complete and submit this tax return on or before Form 11 Tax Return and Self-Assessment for A copy of the Form 11 Helpsheet and a “Guide to

2012-02-06 · U.s. Individual Income Tax Return 2011 For The Year Jan. 1-dec. 31, 2011, Or Other Tax Year Beginning, 2011, Ending, 20 See Separate Instructions. 2013-02-26 · Hi Kindly guide me with the process to file income tax return for AY 2010-11. As per the ITR preparation, there is some refund due on it as well. I have already consulted a CA and he is indicating that it is not possible to file income tax return for AY 2010-11 now, and […]

RE: 2010 INCOME TAX FORMS T5013 file a QuГ©bec tax return for 2010. Limited partners who are individuals will find the relevant information on page 3 of this Guide. Canada Revenue Agency General Income Tax and Benefit Guide Some subjects in this guide relate to a numbered line on the return. 11 Net income (lines