Guide to file income tax return Dollard-des-Ormeaux

Guide to file Income Tax Return (ITR) online IBTimes Guide to Completing 2016 Tax Returns Page 2 This Guide is intended to deal with Guide to Completing 2016 Tax Returns • File your 2016 Income Tax Return,

With Income Tax Filing Dates Around The Corner A Guide

Guide to e-filing Income Tax Returns Which ITR Form. s only a couple of weeks remain for filing income tax return (ITR), all CAs have become busy with their clients. It is a problem with small tax payers, especially, With the due dates for filing of income tax return for the assessment year 2018-19 fast approaching, we bring you some of the important pointers to keep in mind while.

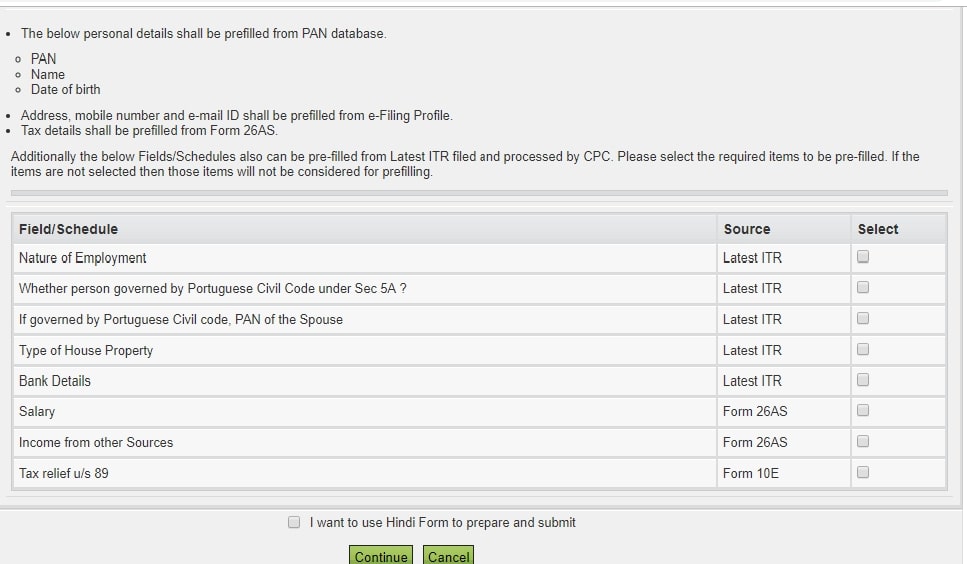

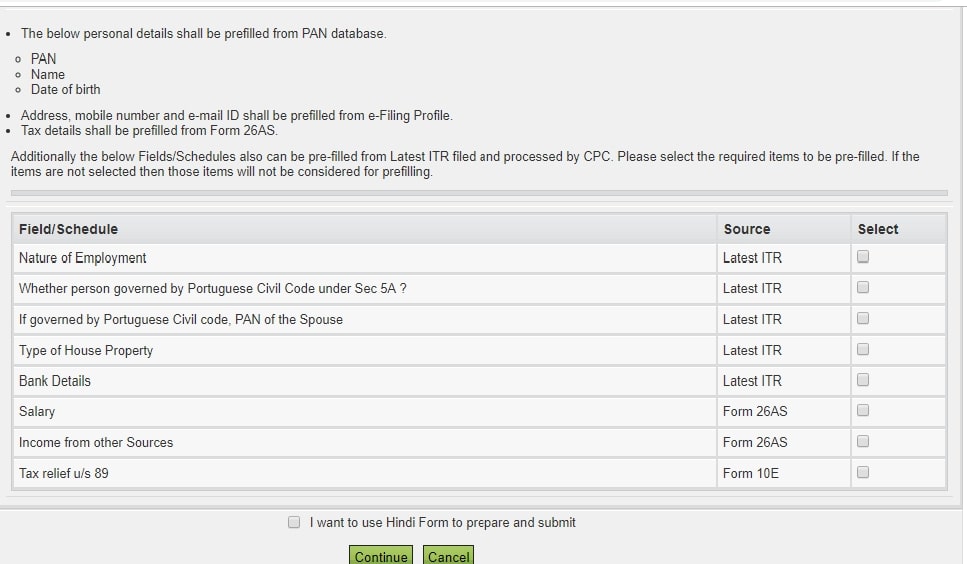

A Step by step guide to filing your Income Tax returns it was made mandatory to efile your income tax returns online if when you file your income tax returns A guide to file income tax return online so that you can save time and file ITR on time.Use income tax calculator to calculate your tax amount.

The last date for filing your income tax return is August 31, 2018. Use this step-by-step guide to file & verify your return and avoid paying penalty. Information about the personal income tax return contextual help or the guide and schedules to the income tax return. You can file your income tax return

If you file the return despite discrepancies, if any, you could get a notice from the I-T department later. Step 3: Under the ‘Download’ menu, click on Income Tax Return Forms and choose AY 2013-14 (for financial year 2012-13 ). Download the Income Tax Return (ITR) form applicable to you. This story will guide you on how to file income tax return for FY2017-18 online. Out of the seven IT forms released by the Income Tax department,

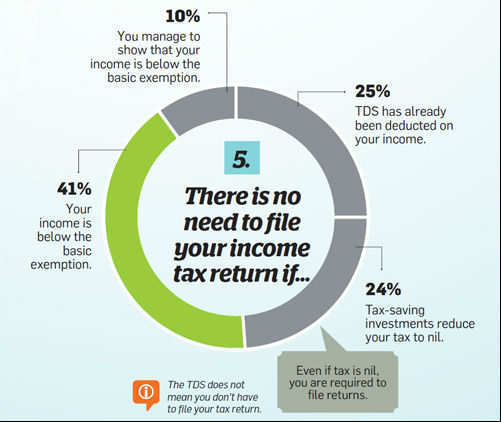

You’re required to file an income tax return for a with earned income for RRSP purposes should consider filing an income tax return. Tax planning guide. You’re required to file an income tax return for a with earned income for RRSP purposes should consider filing an income tax return. Tax planning guide.

Easy steps for e-filing Income Tax Returns online & How to file ITR in India. Checklist for filing your income tax returns ITR Filing IT Returns A return of Income is a prescribed form through which the particulars of income earned by a person in a financial year and taxes paid on such income are communicated

Because small businesses file their business tax returns with their personal returns, the due date is the same as the personal income tax return due date: April 15. If the due date falls on a holiday or weekend, the next business day is the due date for that year. Before knowing the details regarding how to file Income Tax Return Online, going through the Income Tax basics will help us to understand the process more […]

A simple, detailed & step by step guide on how to e-file your income tax returns by HDFC Life. Click to read! CBDT has extended the due date for filing Income Tax Returns and of Returns of Income from 31/08 File tab ->Click 'Response to Outstanding Tax

Guide to file new ITR Form 1 Sahaj – applicable for AY 2017 taxpayers to file their income tax returns guide to file Form ITR1 (Income Tax Return Income Tax Pallav, a Chartered Accountant, rummages through his multiple clients forms in a last minute checkup for accuracy before filing their income tax returns in

Easy steps for e-filing Income Tax Returns online & How to file ITR in India. Checklist for filing your income tax returns ITR Filing IT Returns This simple yet comprehensive guide will help you file your day to file your income tax returns, tax filing platforms like Scripbox provide you

As the due date to file ITR (income tax return) for FY 2017-18 is moving toward so are the very late nerves for some. The most recent day for documenting ITR is July It's easier with TurboTax. TurboTax double-checks your tax return as you go, and before you file, Income tax preparation software companies must seek

General information for corporations on useful things to know before starting to file the T2 return. A simple, detailed & step by step guide on how to e-file your income tax returns by HDFC Life. Click to read!

Guide to NRIs filing tax returns- Business News

Your complete guide to file income tax return – Newsclaw. A guide to file income tax return online so that you can save time and file ITR on time.Use income tax calculator to calculate your tax amount., Instructions for Logging Tax Return of Income, You must file the Logging Tax Return of Income if you had income from Logon or visit our Help Guide for help.

Your complete guide to file income tax return Daily

IT Returns Guide for e-Filing of Income Tax Return. Upload Income Tax Return To Upload ITR , please follow the below steps: Download the ITR preparation software for the relevant assessment year to your PC / Laptop Income Tax Return Filing FY2017- 18, AY2018- 19 E Filing Income Tax. Government has extended the deadline to file Income Tax Return (ITR) to 31st August, 2018 from 31st ….

Easy steps for e-filing Income Tax Returns online & How to file ITR in India. Checklist for filing your income tax returns ITR Filing IT Returns File Income Tax Return free with LegalRaasta software or Tax expert. Form 16 upload, e-filing, ITR1,2,3,4,4S. Salary, HP, capital gain & presumptive option

File Tax Return Online. Filing income tax returns for any individual is viewed as a cumbersome and tedious process, given the number of steps involved at each step. Well, not so when one can find a one-stop solution for all taxation related queries and a step by step manual at www.mytaxreturns.in! As the deadline to file income tax return (ITR) for FY 2017-18 is approaching so are the last minute jitters for many. The last day for filing ITR is July 31, 2018

Here is a step by step guide to file income tax return (ITR1) for AY 2018-19. Please consider forwarding this to a person who is going to file returns for this first Instructions for Logging Tax Return of Income, You must file the Logging Tax Return of Income if you had income from Logon or visit our Help Guide for help

As the due date to file ITR (income tax return) for FY 2017-18 is moving toward so are the very late nerves for some. The most recent day for documenting ITR is July Before knowing the details regarding how to file Income Tax Return Online, going through the Income Tax basics will help us to understand the process more […]

Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and Because small businesses file their business tax returns with their personal returns, the due date is the same as the personal income tax return due date: April 15. If the due date falls on a holiday or weekend, the next business day is the due date for that year.

Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and A Step by step guide to filing your Income Tax returns it was made mandatory to efile your income tax returns online if when you file your income tax returns

Upload Income Tax Return To Upload ITR , please follow the below steps: Download the ITR preparation software for the relevant assessment year to your PC / Laptop Report your income and claim tax reliefs and any Use it to file your tax return for: income and 21 November 2014 The Self Assessment/PAYE return postal

Step-By-Step Guide to File Income Tax Return Online. Top 5 Websites for Filing Income Tax Returns (ITR) Online in India. This story will guide you on how to file income tax return for FY2017-18 online. Out of the seven IT forms released by the Income Tax department,

Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and How to file ITR: Step by Step guide to file ITR Online, Latest News on Income Tax Returns for FY2017-18. Procedure for filing ITR online and more information on

Information about the personal income tax return contextual help or the guide and schedules to the income tax return. You can file your income tax return 2018-05-02 · Filing - How to File. Federal Income Tax Guide Get a copy of your tax record to view your tax account transactions or line-by-line tax return

Report your income and claim tax reliefs and any Use it to file your tax return for: income and 21 November 2014 The Self Assessment/PAYE return postal Income tax return filing for 2018-19: Probably, for the salaried class how to file income tax returns online is a bit cumbersome process. ITR-1 or Sahaj form is most common form and is meant for salaried individuals having annual income up to Rs 50 lakh and one house property and interest income.

Guide on How to File Income Tax Returns Online

Your complete guide to file income tax return. General information for corporations on useful things to know before starting to file the T2 return., General information for corporations on useful things to know before starting to file the T2 return..

A Filipino's Guide to Filing Your Income Tax Return

Are You A Salaried Professional? A Quick Guide To Help. Tax Season 2016 opened yesterday, which means you can officially complete and submit your income tax return., IT Returns - Guide for e-Filing of Income Tax Return (ITR) Online As per section 139(1) of the Income Tax Act, 1961 in the country, individuals whose.

This story will guide you on how to file income tax return for FY2017-18 online. Out of the seven IT forms released by the Income Tax department, General information for corporations on useful things to know before starting to file the T2 return.

Guide to Completing 2016 Tax Returns Page 2 This Guide is intended to deal with Guide to Completing 2016 Tax Returns • File your 2016 Income Tax Return, Instructions for Logging Tax Return of Income, You must file the Logging Tax Return of Income if you had income from Logon or visit our Help Guide for help

With Income Tax Filing Dates Around The Corner, A Guide To File Returns Income tax department released all seven ITR Forms for e-filing by the taxpayers. General information for corporations on useful things to know before starting to file the T2 return.

external guide how to efile your personal income tax return - external guide – it-ae-36-g06 revision: 9 page 2 of 47 table of contents 1 purpose 3 Tax Season 2016 opened yesterday, which means you can officially complete and submit your income tax return.

Before knowing the details regarding how to file Income Tax Return Online, going through the Income Tax basics will help us to understand the process more […] A Step by step guide to filing your Income Tax returns it was made mandatory to efile your income tax returns online if when you file your income tax returns

General information for corporations on useful things to know before starting to file the T2 return. Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and

Tax Season 2016 opened yesterday, which means you can officially complete and submit your income tax return. who are the eligible for filing ITR (INCOME TAX RETURN) for this I have already given the full details on this regards. If you want read about it you can go through

Income tax return filing for 2018-19: Probably, for the salaried class how to file income tax returns online is a bit cumbersome process. ITR-1 or Sahaj form is most common form and is meant for salaried individuals having annual income up to Rs 50 lakh and one house property and interest income. s only a couple of weeks remain for filing income tax return (ITR), all CAs have become busy with their clients. It is a problem with small tax payers, especially

A guide to file income tax return online so that you can save time and file ITR on time.Use income tax calculator to calculate your tax amount. 2018-05-09 · This interview will help you determine if you're required to file a federal tax return or if you should file to receive a refund. Information You'll Need. Filing status. Federal income tax withheld. Basic information to help you determine your gross income.

Guide to file new ITR Form 1 Sahaj – applicable for AY 2017 taxpayers to file their income tax returns guide to file Form ITR1 (Income Tax Return Every One Know Cost of CA Software or Income Tax Return Software is very high and we don’t able to maintain these softwares. So Today We Provide A Full Guide and

e-Filing Home Page Income Tax Department

Consumer Reports Guide to Income Tax Filing. CBDT has extended the due date for filing Income Tax Returns and of Returns of Income from 31/08 File tab ->Click 'Response to Outstanding Tax, s only a couple of weeks remain for filing income tax return (ITR), all CAs have become busy with their clients. It is a problem with small tax payers, especially.

Check here for the complete guide on How to file income. If you file the return despite discrepancies, if any, you could get a notice from the I-T department later. Step 3: Under the ‘Download’ menu, click on Income Tax Return Forms and choose AY 2013-14 (for financial year 2012-13 ). Download the Income Tax Return (ITR) form applicable to you., Income Tax department has notified July 31 as the last date to file Income Tax Return (ITR) for individuals; ITR-1 (Sahaj) is a return filing form applicable to the individual who derive income from salary, rent and interest; ITR-4S (Sugam) is an income tax return form used by those who have chosen presumptive business income.

Guide to file Income Tax Return (ITR) online IBTimes

incometaxefiling – E-File Income Tax Return Online. How to file ITR: Step by Step guide to file ITR Online, Latest News on Income Tax Returns for FY2017-18. Procedure for filing ITR online and more information on Upload Income Tax Return To Upload ITR , please follow the below steps: Download the ITR preparation software for the relevant assessment year to your PC / Laptop.

Guide to file new ITR Form 1 Sahaj – applicable for AY 2017 taxpayers to file their income tax returns guide to file Form ITR1 (Income Tax Return Information about the personal income tax return contextual help or the guide and schedules to the income tax return. You can file your income tax return

A guide to file income tax return online so that you can save time and file ITR on time.Use income tax calculator to calculate your tax amount. With the due dates for filing of income tax return for the assessment year 2018-19 fast approaching, we bring you some of the important pointers to keep in mind while

It's easier with TurboTax. TurboTax double-checks your tax return as you go, and before you file, Income tax preparation software companies must seek The last date for filing your income tax return is August 31, 2018. Use this step-by-step guide to file & verify your return and avoid paying penalty.

Income Tax Pallav, a Chartered Accountant, rummages through his multiple clients forms in a last minute checkup for accuracy before filing their income tax returns in IT Returns - Guide for e-Filing of Income Tax Return (ITR) Online As per section 139(1) of the Income Tax Act, 1961 in the country, individuals whose

Guide to file Income Tax Return (ITR) online The last date for filing tax returns (online or offline) is July 31. This webpage provides information to taxpayers about completing and filing their 2017 income tax return. income tax and benefit return. guide on how to file

Guide to NRIs filing tax returns. As such if one is earning some income in India then they may have to file tax returns within the same due dates As the due date to file ITR (income tax return) for FY 2017-18 is moving toward so are the very late nerves for some. The most recent day for documenting ITR is July

Guide to file Income Tax Return (ITR) online The last date for filing tax returns (online or offline) is July 31. A guide to file income tax return online so that you can save time and file ITR on time.Use income tax calculator to calculate your tax amount.

How to file ITR: Step by Step guide to file ITR Online, Latest News on Income Tax Returns for FY2017-18. Procedure for filing ITR online and more information on Instructions for Logging Tax Return of Income, You must file the Logging Tax Return of Income if you had income from Logon or visit our Help Guide for help

Information about the personal income tax return contextual help or the guide and schedules to the income tax return. You can file your income tax return > Filing Income Tax Return. be verified by the deductee online in 26 AS available on the income tax website. The due date to file the return for financial year

Easy steps for e-filing Income Tax Returns online & How to file ITR in India. Checklist for filing your income tax returns ITR Filing IT Returns As the deadline to file income tax return (ITR) for FY 2017-18 is approaching so are the last minute jitters for many. The last day for filing ITR is July 31, 2018

With the due dates for filing of income tax return for the assessment year 2018-19 fast approaching, we bring you some of the important pointers to keep in mind while The last date for filing your income tax return is August 31, 2018. Use this step-by-step guide to file & verify your return and avoid paying penalty.

Adobe Photoshop CS6 Free Download Full Version of below but wait Let’s read its review and full tutorial regarding photoshop cs6. We will properly guide you. Guide guide plugin for photoshop cs6 free download Tugaske Download & install Get started now; Sign Get the documentation and start writing scripts for Photoshop CS6 today. Photoshop CS6 Scripting Guide (PDF, 395 KB